Following the signing of the Deed of Sale and the receipt of payment by the Seller, we enter the most critical phase of the real estate transaction.

You may wonder why this stage is so significant.

The first step is to approach the Bureau of Internal Revenue (BIR) to request the Certificate Authorizing Registration (CAR) issuance. The CAR is essential; without it, the title cannot be transferred to the Buyer.

In addition to obtaining the CAR, the BIR will calculate the following:

- Capital Gains Tax (CGT): The Seller is responsible for this tax by law. As of this writing, the CGT is 6% of the total amount, which is determined by the highest value among the following three options:

- Zonal Value

- Fair Market Value

- Selling Price as indicated in the Deed of Sale

- Documentary Stamp Tax (DST): This tax is the buyer’s responsibility. The BIR computes the DST by applying a rate of 1.5% to the highest value determined previously.

It is important to note that tax payments must be made through accredited banks designated by each BIR branch or Revenue District Office (RDO).

To facilitate a smooth transaction, closing the transaction—meaning the signing of the Deed of Sale and payment—is advisable during the first week of the month. This timing helps ensure compliance with the BIR’s deadlines for CGT and DST payments.

So, why is this phase considered the most crucial?

In addition to the importance of the CAR, both parties—the Seller and the Buyer—will gain clarity on their respective tax obligations, enabling the Seller to determine their net income and the Buyer to calculate their total cash outlay.

Requirements for Submission to the BIR

To successfully secure the CAR, the following documents must be prepared:

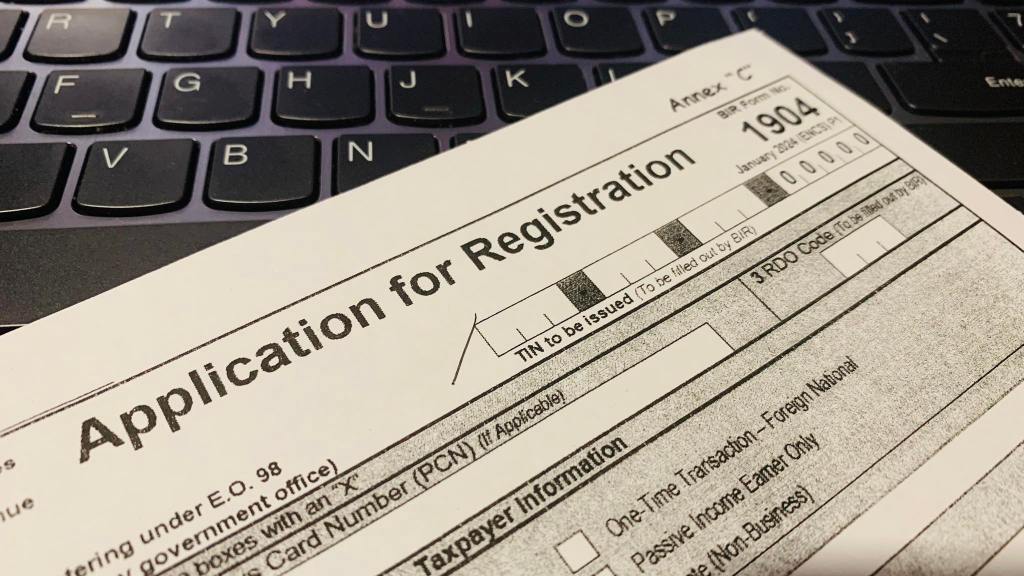

- Both parties, the Seller and the Buyer, must complete and sign BIR Form 1904 in triplicate.

- Original notarized Deed of Sale, copies of valid IDs for both parties and two sets of photocopies.

- Original notarized Special Power of Attorney (SPA), plus two photocopies. If the person submitting the documents is not one of the parties, the Buyer or new owner must execute an SPA authorizing that individual to transact with the BIR, pay taxes, and secure the CAR.

- A certified true copy of the property title, along with two sets of photocopies, is needed.

- A certified true copy of the Tax Declaration, along with two sets of photocopies.

- Copies of valid IDs for both the Seller and the Buyer are required. A valid ID for the authorized person or Attorney-in-Fact is also needed.

- If the Seller is a business entity, it is advisable to provide proof that the property has been used as a personal dwelling rather than for business purposes. Otherwise, the BIR may require the Seller to issue a Service Invoice to the Buyer.

- If the property is a vacant lot, you also need to submit a Certificate of No Improvement, which you can get from the City Assessor.

- It is recommended that an acknowledgment of full payment be included as an integral part of the Deed of Sale.

The timeline for obtaining the CAR is typically around two weeks from the complete submission of the required documents.

About Ronnie Reyes

Ronnie Reyes has been a licensed real estate broker since 1993 and was among the pioneer employees of Ayala Land from 1989 to 2000. With extensive experience in marketing, sales, and customer relations, Ronnie transitioned from the corporate sector in 2000 to become a comprehensive service provider. Today, his core business areas include real estate, health, insurance, and investments. He is trusted by numerous company presidents, CEOs, general managers, top-level executives, and well-established professionals in the Philippines.

Leave a comment